Home

Chronicles

ATOM

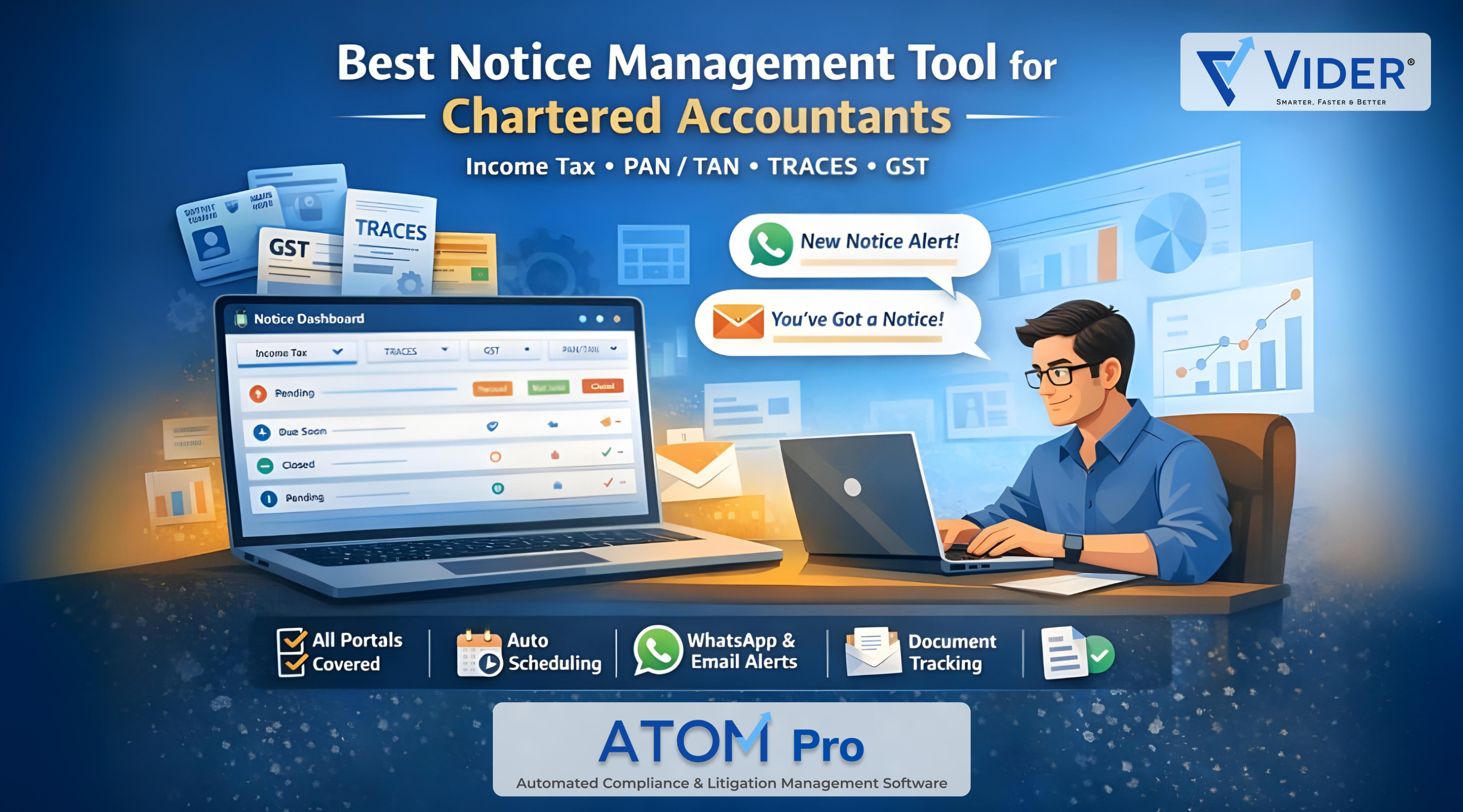

Best Notice Management Tools for Chartered Accountants in 2026: A Hands-On Review of ATOM Pro

By CA Chikyala Abhinav |

Updated on:Jan 10, 2025 15:16

|

16 min read

Best Notice Management Tools for Chartered Accountants in 2026: A Hands-On Review of ATOM Pro

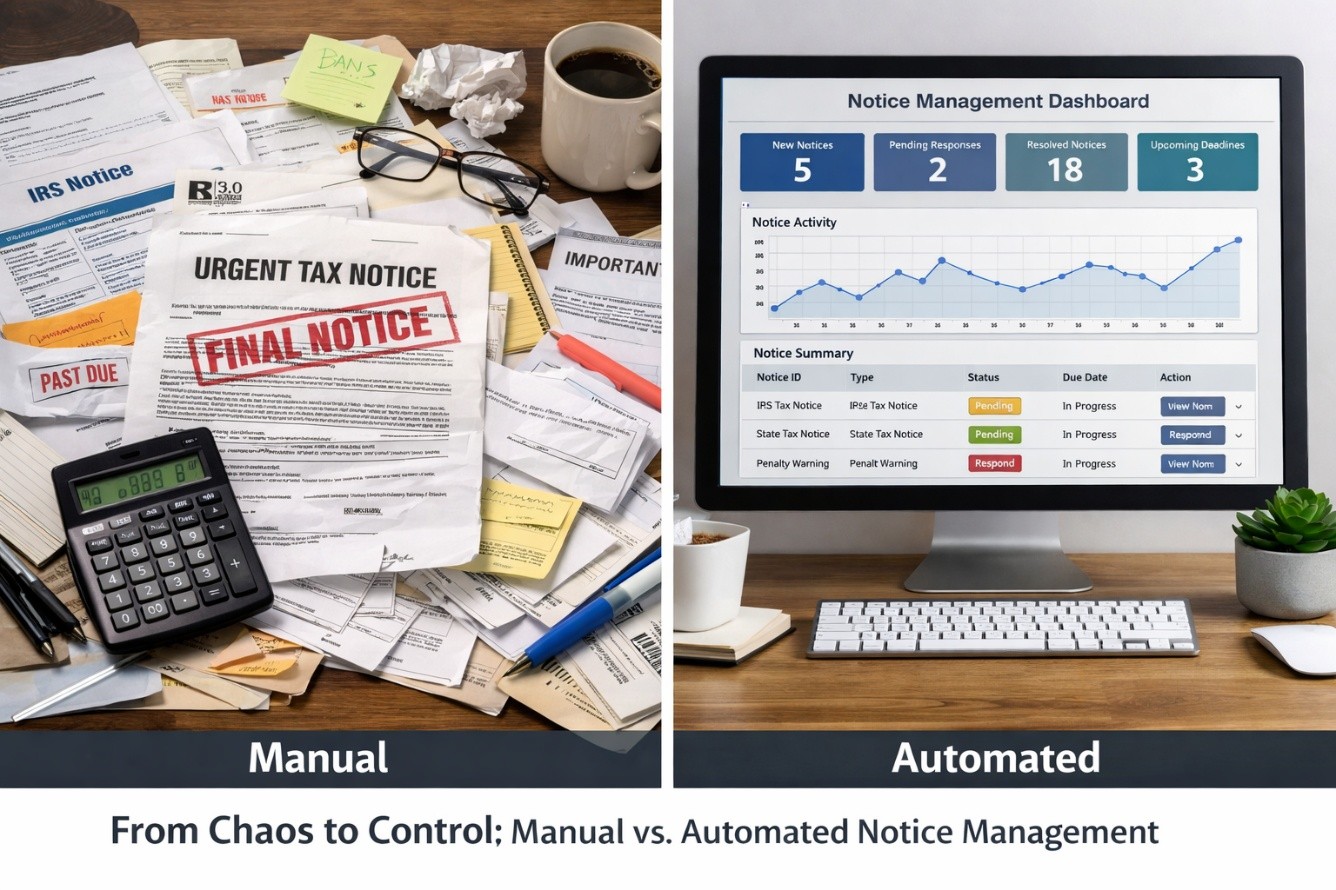

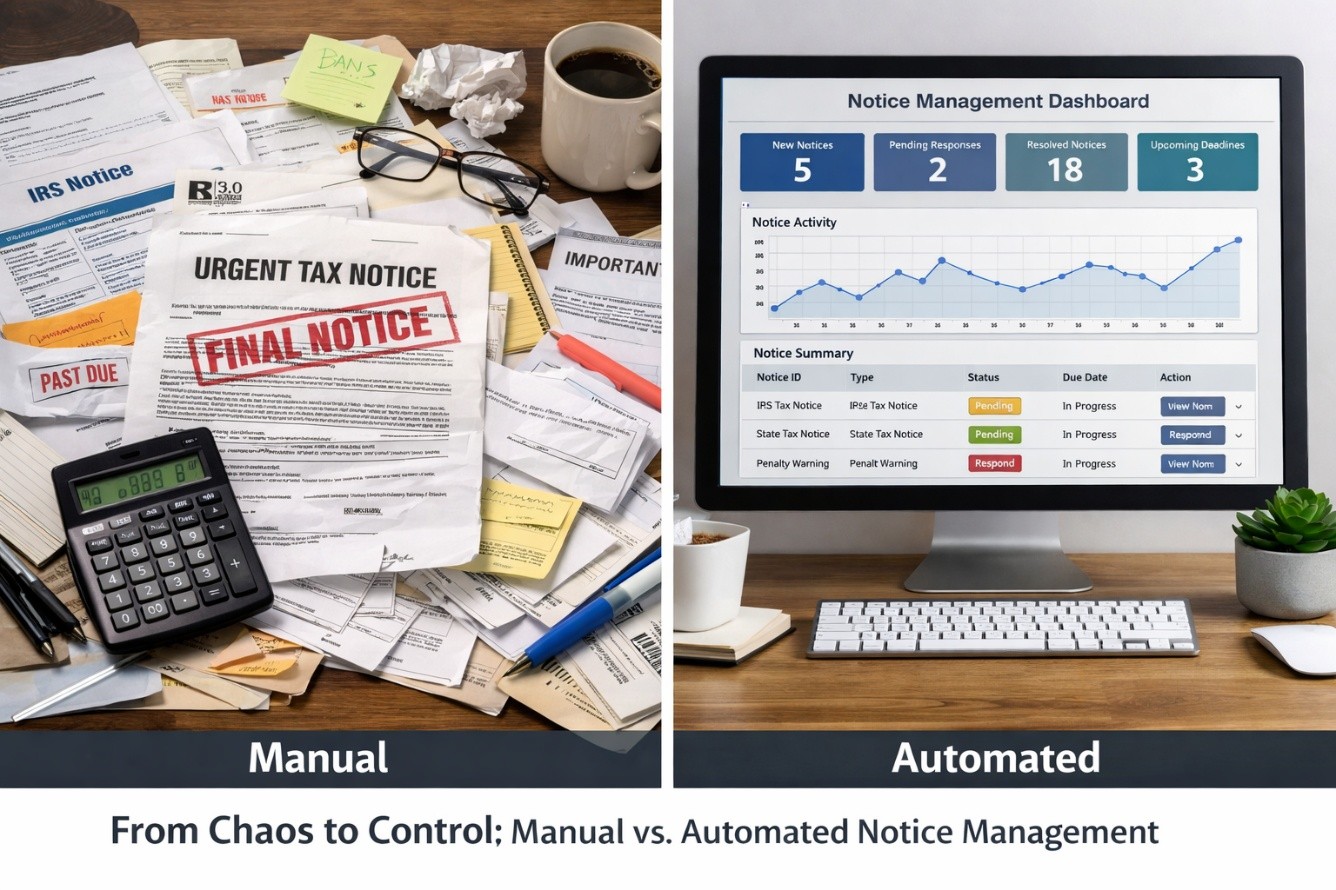

As a fellow Chartered Accountant, I know the drill. The month-end rush, the constant portal logins, and that

sinking feeling when a client forwards a 15-day-old GST notice they "just saw" in their email.

In our profession, notice management is risk management. If you are still manually checking

the Income Tax and GST portals for every PAN/TAN, you aren't just losing time—you’re playing with fire.

Here is a blog post I've drafted from my perspective as an active user of

ATOM Pro, detailing why this shift is mandatory for a modern CA firm.

What is Notice Management for Chartered Accountants?

Notice management involves tracking, organizing, and responding to official communications from tax

authorities. For CAs, it's not just about filing returns – it's about monitoring ongoing proceedings to

avoid penalties, interest, or legal hassles. A good tool automates this process, pulling data from portals

like Income Tax e-filing (PAN), TAN, TRACES (TDS), and GSTN.

In 2026, with increasing digital scrutiny from the government, manual tracking via spreadsheets is outdated.

Tools like ATOM Pro integrate directly with these portals, saving hours and reducing errors. As per recent

CBDT updates, timely responses to notices can prevent escalation, making automation a must-have.

Essential Features of a Notice Management Tool for Income Tax (PAN), TAN, TRACES, and GST

Based on my experience, here's what every robust notice management tool should include. These features

ensure

comprehensive coverage across tax regimes.

1. Automated Notice Fetching and Integration

For Income Tax (PAN): Real-time syncing with the e-filing portal to fetch notices under

sections like 143(1), 148, or 271. The tool should categorize them by type (e.g., intimation, reassessment)

and link to client PAN details.

For TAN: Direct pull from the TAN portal for TDS-related notices, including defaults or

mismatches.

For TRACES: Integration with TRACES for TDS/TCS notices, such as short deductions or late

filings,

with auto-download of justification reports.

For GST: Seamless GSTIN access to retrieve notices like SCN (Show Cause Notice), DRC-01

(Demand),

or ASMT-10 (Scrutiny), tied to GSTIN.

Why Essential: Manual logins to multiple portals waste time. Automation ensures nothing

slips through.

2. Centralized Dashboard and Tracking

A unified view of all notices across clients, with filters by status (pending, responded, closed), due

dates,

and authority.

Timeline tracking for each notice, showing issuance date, response deadline, and follow-up history.

3. Deadline Reminders and Compliance Calendar

Built-in calendar syncing with statutory deadlines (e.g., 30 days for GST SCN response).

Escalation alerts for approaching due dates, with color-coded urgency (red for <7 days).

4. Document Management

Secure storage for notice PDFs, client documents, and response drafts.

5. Reporting and Analytics

Exportable reports on notice trends (e.g., most common GST issues per client).

6. Team Collaboration and Permissions

Role-based access: Partners view all, juniors handle assigned notices.

Why ATOM Pro is the Best Notice Management Tool for CAs

As an ATOM Pro user, I can confidently say it excels in all the above areas. Its Litigation Management

module

is tailored for Indian CAs, integrating seamlessly with Income Tax, TAN, TRACES, and GST portals.

Automated Fetching: ATOM Pro auto-pulls notices daily.

Dashboard: The intuitive interface shows all notices in one place. I filter by GSTIN or PAN, and it

highlights

TRACES defaults instantly.

Reminders: The compliance calendar is a lifesaver, syncing with TAN and GST deadlines.

Reports: I generate client-wise analytics, spotting patterns like frequent TDS mismatches.

Advanced Features in ATOM Pro: Auto-Scheduling, WhatsApp/Email Notifications, and More

Auto-Scheduling automatically fetches notices from Income Tax, GST, and TDS/TRACES portals even when the

system

is offline.

Instant WhatsApp and Email Notifications alert me the moment a new notice arrives.

Final Thoughts: Is ATOM Pro Worth It for Your CA Practice?

If you're overwhelmed by notices from Income Tax, PAN, TAN, TRACES, or GST, a dedicated tool is

non-negotiable.

ATOM Pro isn't just good – it's the best notice management tool for chartered accountants in 2026.

Vider Contact Details: